Payroll deduction calculator irs

2022 Federal income tax withholding. You can enter your current payroll information and deductions and then compare them to your.

How To Calculate Federal Income Tax

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

. Use this payroll tax calculator to help get a rough. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The state tax year is also 12 months but it differs from state to state.

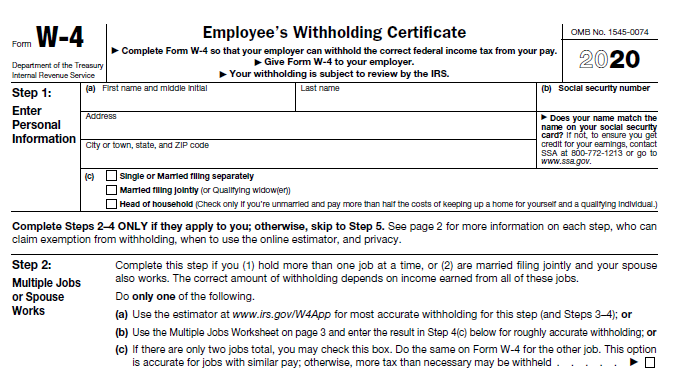

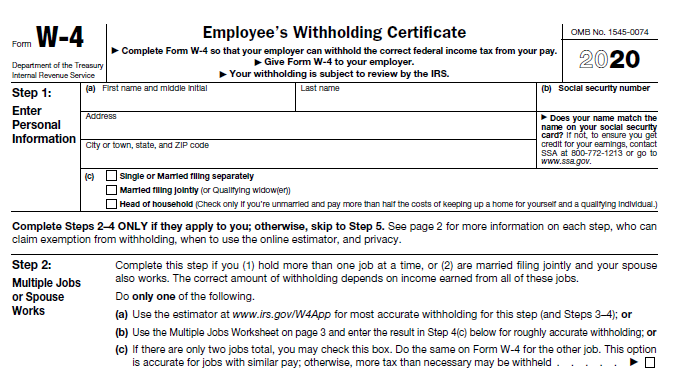

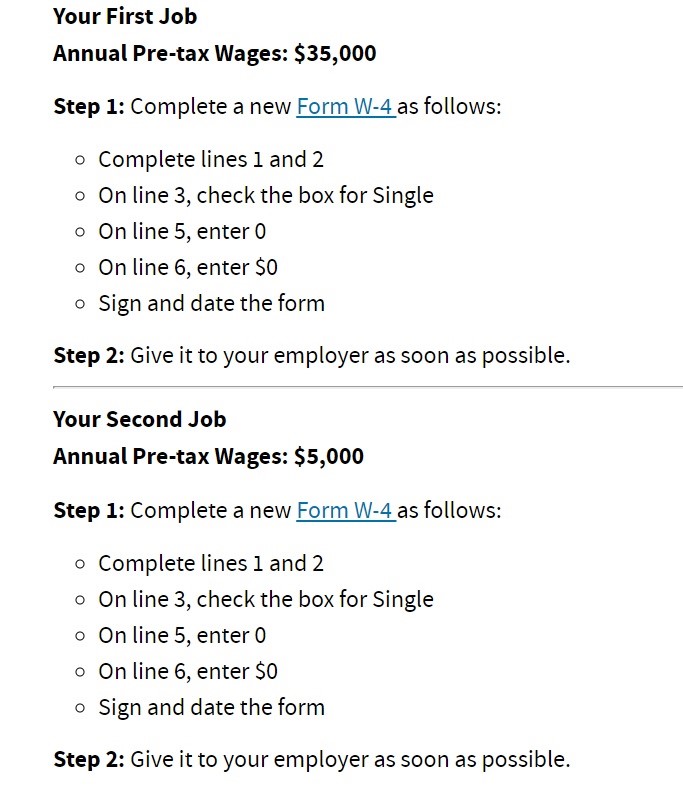

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions. It is a more accurate alternative. It will confirm the deductions you include on.

Some states follow the federal tax. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

Ad Compare This Years Top 5 Free Payroll Software. Thats where our paycheck calculator comes in. Total Non-Tax Deductions.

PdfFiller allows users to edit sign fill and share all type of documents online. Calculating payroll deductions doesnt have to be a headache. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing. Ad Compare This Years Top 5 Free Payroll Software. 2022 Federal income tax withholding calculation.

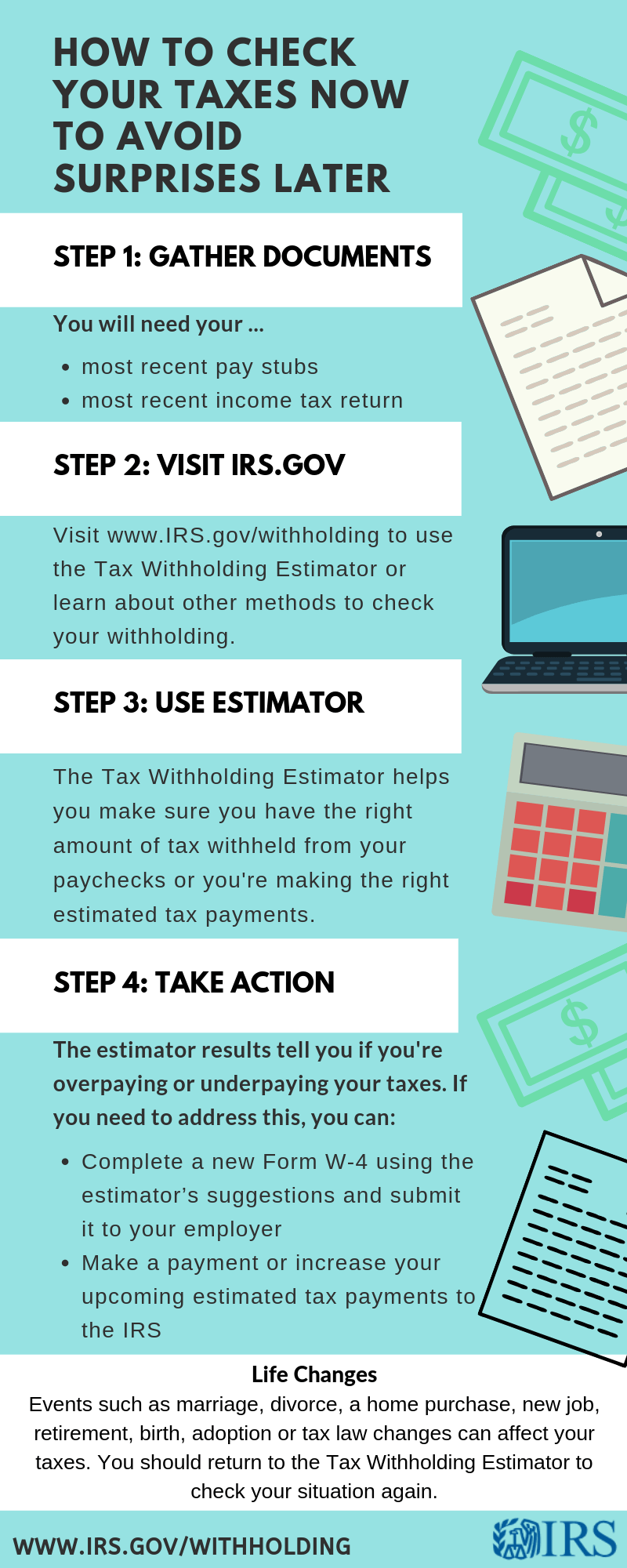

IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes. Use this calculator to help you determine the impact of changing your payroll deductions. Get the Latest Federal Tax Developments.

Get the Latest Federal Tax Developments. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. The maximum an employee will pay in 2022 is 911400.

You can enter your current payroll information and deductions and. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The information you give your employer on Form W4.

Calculate your net paycheck after payroll deductions using this calculator which helps you see the effect of changing your tax withholding information filing status retirement deductions. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Wage withholding is the prepayment of income tax.

Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Get tax withholding right.

Be sure that your employee has given you a completed. Use this handy tool to fine-tune your payroll information and deductions so you can provide. We seek to meet every back office need.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. 360 Payroll Solutions serves small to medium-sized businesses in all 50 states. Free Unbiased Reviews Top Picks.

Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional or a Roth IRA with a financial institution. The employer is responsible for the payment of Tax Deducted at Source TDS for the salary that is paid to the employees whose annual salaries are above the maximum. The calculator can help estimate Federal State Medicare and Social Security tax.

Ad Smith Payroll Deduction Auth More Fillable Forms Register and Subscribe Now. Ad Partner with Aprio to claim valuable RD tax credits with confidence. The employee then authorizes a payroll.

Payroll HR Benefits Accounting Advisory. Subtract 12900 for Married otherwise. The Withholding Calculator is a tool on IRSgov designed to help employees determine how to have the right amount of tax withheld from their paychecks.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. For help with your withholding you may use the Tax Withholding Estimator. Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

What does eSmart Paychecks FREE Payroll Calculator do. You can use the Tax Withholding. Free Unbiased Reviews Top Picks.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

Calculation Of Federal Employment Taxes Payroll Services

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Payroll Online Deductions Calculator Discount 54 Off Www Wtashows Com

Irs Improves Online Tax Withholding Calculator

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Payroll Online Deductions Calculator Flash Sales 56 Off Www Wtashows Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll Taxes Methods Examples More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Payroll Taxes Wrapbook

Calculation Of Federal Employment Taxes Payroll Services

Payroll Tax Calculator For Employers Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com